san fran sales tax rate

Web The South San Francisco California sales tax is 925 consisting of 600 California state sales tax and 325 South San Francisco local sales taxesThe local sales tax consists of a 025 county sales tax a 050 city sales tax and a 250 special district sales tax used to fund transportation districts local attractions etc. The December 2020 total local sales tax rate was 8500.

Understanding California S Sales Tax

This includes the rates on the state county city and special levels.

. The South San Francisco sales tax rate is. Did South Dakota v. The tax is calculated as a percentage of total payroll expense based on the tax.

State Government 415 356-6600. Web California City and County Sales and Use Tax Rates Rates Effective 04012017 through 06302017 1 P a g e Note. You can find more tax rates and allowances for San Francisco County and California in the 2022 California Tax Tables.

The December 2020 total local sales tax rate was. Web The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc. MandateFee Letter means the Administrative Agents.

The current total local sales tax rate in San Francisco CA is 8625. The California sales tax rate is currently 6. 2020 rates included for use while preparing your income tax deduction.

Did South Dakota v. Web What is the sales tax rate in South San Francisco California. This is the total of state county and city sales tax rates.

The minimum combined 2022 sales tax rate for South San Francisco California is. 121 Spear St Ste 460. This is the total of state county and city sales tax rates.

Credit card services may experience short delays in service on Wednesday August 24 from 700 pm. What is San Francisco sales tax rate 2020. The San Francisco sales tax rate is.

Web The average cumulative sales tax rate in San Francisco California is 864. To 1000 pm Pacific time due to scheduled. The California sales tax rate is currently 6.

The December 2018 total local sales tax rate was also 8500. Web The latest sales tax rate for San Francisco County CA. This rate includes any state county city and local sales taxes.

Name A - Z Sponsored Links. The California sales tax rate is currently. Web The City currently imposes a 25 tax on total parking charges for all off-street parking throughout the City.

The County sales tax rate is 025. Web The latest sales tax rate for San Francisco CA. The current total local sales tax rate in San Francisco CA is 8500.

Web Payroll Expense Tax. Web The minimum combined sales tax rate for San Francisco California is 85. Web How much is sales tax in San Francisco.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day of February for the prior calendar year Jan. San Francisco CA Sales Tax Rate. Ad Find Out Sales Tax Rates For Free.

The minimum combined 2022 sales tax rate for San Francisco California is. Web The 85 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 225 Special tax. The current sales tax rate in California is 6.

San Francisco County has a 025 percent sales tax. Fast Easy Tax Solutions. The current total local sales tax rate in San Francisco CA is 8500.

This is the total of state county and city sales tax rates. Next to city indicates incorporated. Web San Francisco Californias minimal combined sales tax rate for 2020 is 85 percent.

This is the total of state county and city sales tax rates. The County sales tax rate is. Web Sales Tax Rate in San Francisco CA.

San Francisco County in California has a tax rate of 85 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in San Francisco County totaling 1. Within San Francisco there are around 39 zip codes with the most populous zip code being 94112. Web The minimum combined sales tax rate for San Francisco California is 85.

Web 1788 rows Businesses impacted by recent California fires may qualify for extensions tax relief and more. Web San Francisco County Sales Tax Rates for 2022. Please visit our State of Emergency Tax Relief page for additional information.

Also what is the mandatory fee. The December 2020 total local sales tax rate was 8500. The County sales tax rate is.

Web The South San Francisco California sales tax is 750 the same as the California state sales taxWhile many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected. The San Francisco County Sales Tax is collected by the. The minimum combined sales tax rate for San Francisco California is 85.

This is the total of state county and city sales tax rates. 2020 rates included for use while preparing your income tax deduction. The California sales tax rate is currently 6.

The County sales tax rate is 025. The California sales tax rate is currently. If an operator receives 40000 or less per year in parking revenue.

Parking Operators file and pay taxes monthly and have additional requirements including a Certificate of Authority a Parking Bond and Revenue Control Equipment fees. This rate includes any state county city and local sales taxes. Web What is the sales tax rate in San Francisco California.

State Government Sales Use Tax. This is the sum of the sales tax rates in the state county and city. There is no applicable city tax.

San Francisco has parts of it located within San Mateo County.

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

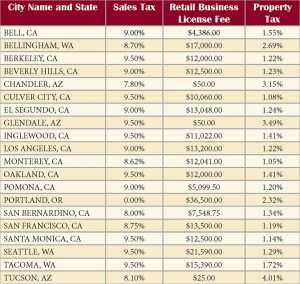

California Cities Among Most Expensive In West To Do Business Advocacy California Chamber Of Commerce

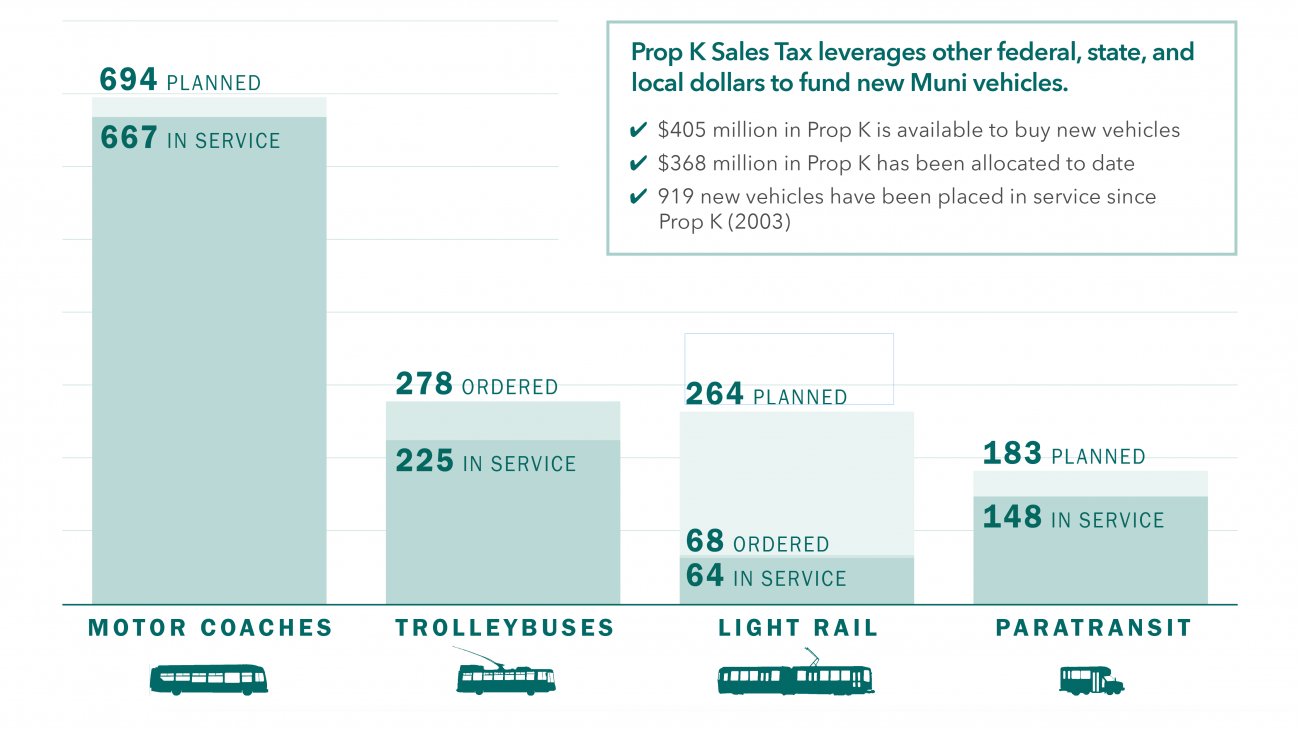

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

California Sales Tax Rate By County R Bayarea

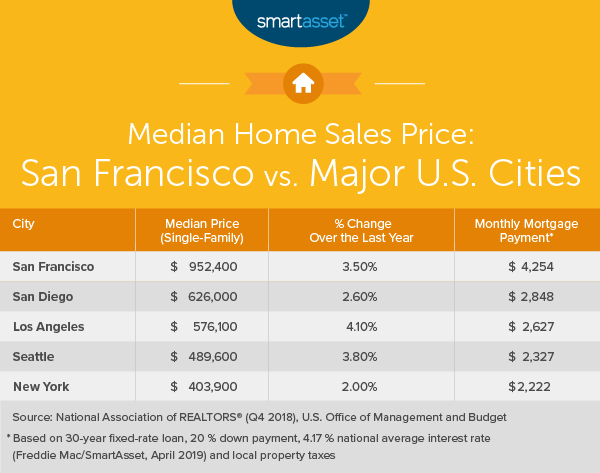

What Is The True Cost Of Living In San Francisco Smartasset

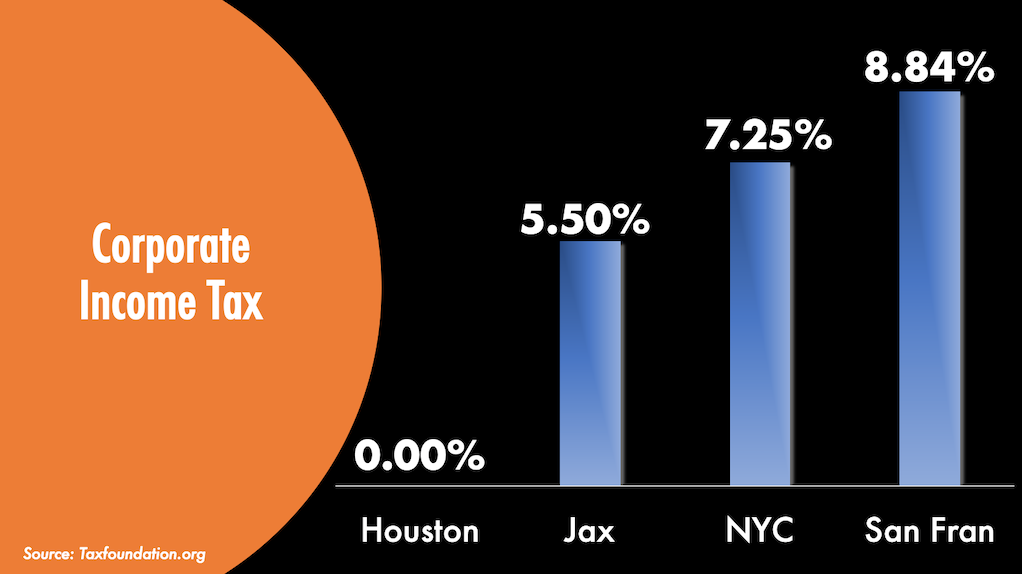

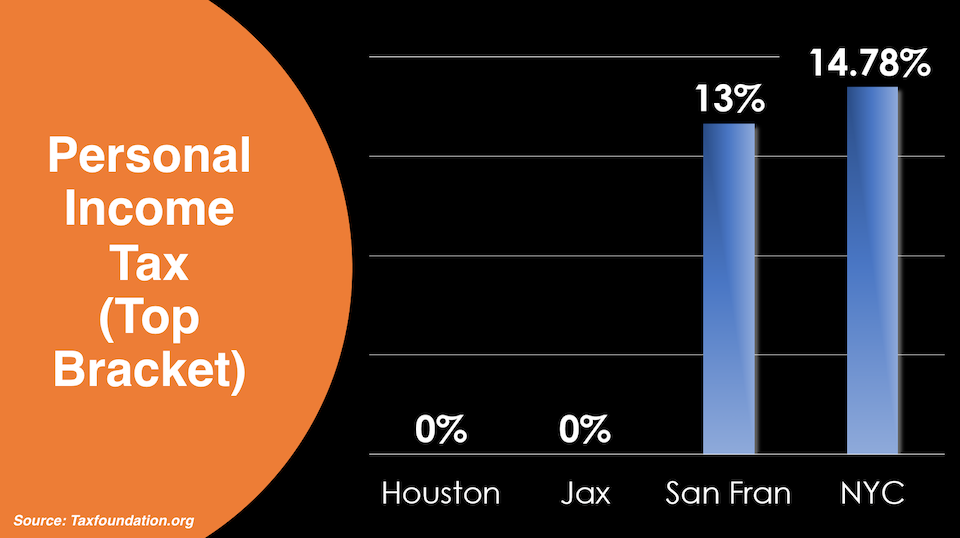

The Pros And Cons Of Locating Your Business In San Francisco

California Sales Tax Rates By City County 2022

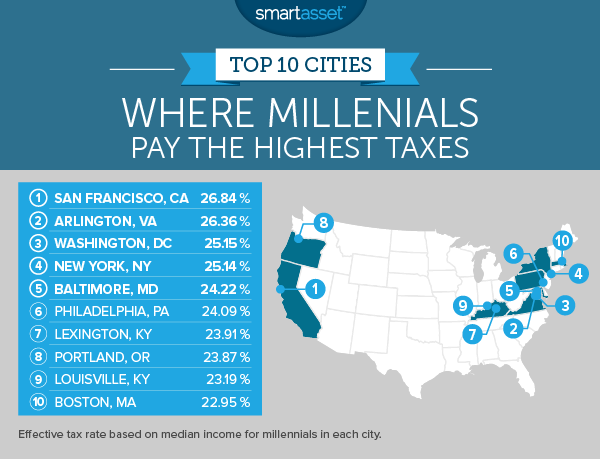

Where Millennials Pay The Highest Taxes In 2016 Smartasset

Understanding California S Sales Tax

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Why Households Need 300 000 To Live A Middle Class Lifestyle

The Pros And Cons Of Locating Your Business In Nyc

San Francisco Prop W Transfer Tax Spur

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia